FI-light-ER post 5.0 / FirstPublished20200603 www.filighter.com

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

Disclaimer: We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. FIlighter accepts no responsibility for any actions or activities you may take based on anything discussed on the website, postings, or comments.

=================================================

5.0 –> Spoiler Alert…it isn’t rocket science…this Turbocharger may get you to early retirement quicker than you think! How about an extra million dollar$ for your nest egg?

There was a brief example in my last post that really bears its own post. This one tool in your FI path tool box can accelerate your arrival at Financial Independence. First let’s discuss WHY it matters then reveal the Turbocharger!

Frequently you hear the term “Grow the Gap”. I personally close every post with “Mind the Gap!” taken from a trip to London a few years back. When riding the subway train the announcer warns everyone to mind the gap between the platform and the train door for your safety. So my message is Mind the Gap for the benefit of growing the Gap and accelerating your path to Financial Independence.

The formula is really simple; Plus/Add Income Minus/Less Expenses equals the Gap.

+Income – Expenses = The GAP

The Gap is what you have left over to invest, provide emergency funds, save for a large purchase, fuel your dreams, and create Financial Independence. The larger the Gap the more fuel you have to Grow Assets. In post 4.0 we discussed Net Worth in detail and the growth of assets coupled with reducing liabilities is the key to building net worth.

The simple formula above gives you two means to grow the gap. Increase your income, or decrease your expenses. Either or both will work to accelerate your path to FI along with increased cash flow each month and who doesn’t need a little more breathing room in the budget. The opposite actions delay your path to retirement, i.e. lower income and higher expenses delay your ability to accumulate the asset base required to sustain your retirement lifestyle. Several terms in the previous sentence are outside the scope of this posting, we will not cover the size of assets required or what your retirement lifestyle will cost. Those factors are highly personal and geographically driven. What we will focus on is the Turbocharger that could greatly reduce your expenses particularly if you have a longer horizon to your early retirement. This could be the key to Early Retirement or perhaps FAT FI (see Physician on FIRE definition of FAT FI).

The Turbocharger I’m speaking about is what vehicle you drive. Most families spend the largest piece of their income on their home. Right behind housing costs is transportation. Typical couples have two vehicles or more and when their children obtain drivers licenses. Our fleet maxed out at 6 vehicles and at the peak, the last three vehicle purchases were what we called Econoboxes (my coming of driving age terminology). Per Wikipedia definition, “Econobox is a United States informal slang term for a small, boxy, fuel-efficient economy car with few luxuries and a low price. The term is typically used for cars from the 1970s and 1980s”. I wish I could say this was always my philosophy; however the marketing and debt culture worked its spell on me as it does many if not most young professionals. I graduated, started my first job in public accounting at $23,500 per year and 6 months later scraped together a down payment for a brand new car and actually drove it right off the showroom floor. It was a 1985 Dodge ES Turbo Convertible all mine for $16,800 (does anyone think spending >70% of your gross pay on a car is reasonable?). Not three months earlier, my dad suggested I consider a Chevy Chevette which could be bought for $6,000. I had the Ray-ban sunglasses and a black turbo convertible with alloy wheels, leather seats, and a cassette tape deck. I loaded up my buddies and cruised Westheimer listening to Dire Straits “Walk of Life” or “Money for Nothing”…but I digress. While on this dream look back tangent, had I invested the $10,000 difference saved in the SP500 and reinvested the dividends, it would now be over $325,000, but hey…I looked really good in that car. #stupidlessons #hindsightin2020

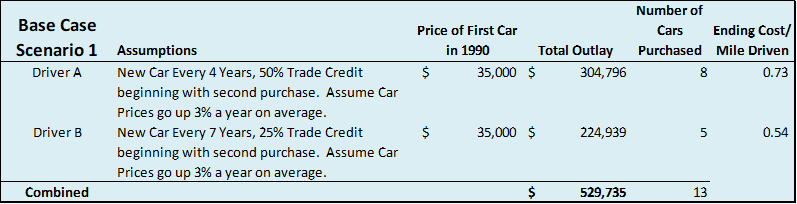

Let’s look at a data based scenario for three couples that buy their first cars in 1990 and continue to own two cars for 30 years ending with 2019. Both drivers will purchase equal cars to begin. Holding periods will vary as will trade in credits as detailed in each scenario assumptions below. For all scenarios, we assume cars are purchased for cash; any interest costs would be additional. We used an average 14,000 miles driven per year and maintenance and insurance costs were ignored. It could be argued that maintenance would be higher on cars held for longer periods; these costs may be partially offset by lower insurance costs. In any event as you will see the savings significantly exceed incremental maintenance cost.

In the above scenario image one driver having the newer car and the other driver holding their vehicle slightly longer. Many couples end up passing cars down or taking turns buying so the cost doesn’t hit in the same year. If children are involved and they get one of the vehicles, obviously the trade in would not happen and costs to maintain an additional vehicle would be added. We are sticking to Scenario 1 as our base case and not adding a 3rd vehicle or downsizing to 1 vehicle during the 30 year period.

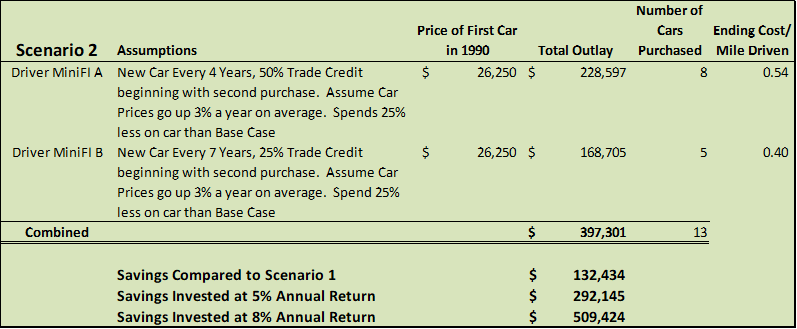

Now let’s make a small adjustment moving to Turbocharging our pursuit of FI. Scenario 2 has the same assumptions on holding vehicles, however Drivers MiniFI A & B spend 25% less on vehicles.

As in Scenario 1, the MiniFI drivers end up purchasing 13 vehicles over the 30 year period, however with a modest move to a bit less luxury the Scenario 2 couple’s decision to spend 75% of the base case cost on a vehicle saves them $132,434 in straight cash. If the savings are invested when achieved at a very conservative 5% rate, they will have $292,145 more in their nest egg at the end of 2019. That’s like getting a $100,000 bonus check every 10 years falling out of the sky! If a slightly higher 8% investment return assumption is used, the difference swells to $509,424 over 30 years and what did they give up? They chose a mid-level trim package instead of a loaded premium vehicle. Friends, these are real savings, hundreds of thousands of dollars that would go to your personal financial independence rather than the pockets of the auto makers, dealer networks, and lending institutions.

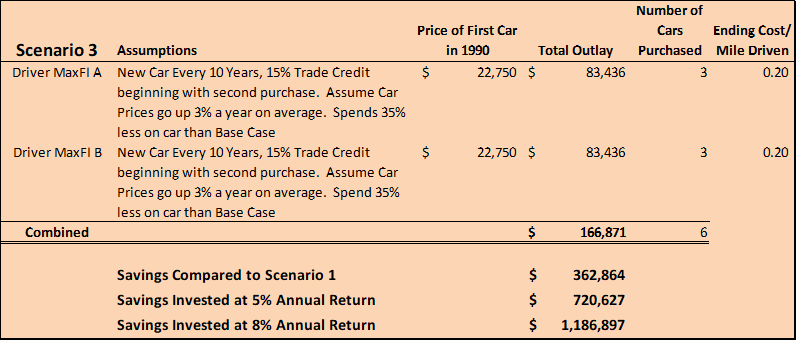

In this third scenario, we will call them the MaxFI drivers. They get more aggressive on their pursuit of FI. This couple spends even less on the first cars and both drivers hold their vehicles for 10 years.

The Scenario 3 MaxFI couple is handsomely rewarded for their pursuit of FI by holding modest priced vehicles for 10 years and as a result during the 30 year period, they only purchase 6 vehicles and their savings compared to the base case invested at 5% generate $720,627 at the end of 2019. With slightly higher investment assumptions of 8%, the savings generate $1.2 million! Yes, the decision to buy less and hold longer can single handedly make you a millionaire in 30 years (assuming you are not running up debt in excess of your assets elsewhere).

The new car bug can bite anyone. The question is; have you really done the math? Do sales tactics or in your face marketing campaigns work on you? Do you fall for the “monthly payment” sales strategy? How about zero percent interest? Rebates? Do you believe you will always have a car payment? Did you trade a car that wasn’t paid off and end up “upside down” on that next car rolling the old balance due into the new loan and leaving the dealership with more debt than the new car was worth? Have you sold a car and after settling with the buyer, withdrawn thousands from your bank account to pay off the upside down loan? Did you trade a car just because it had 100,000 miles on it (I did because the car was supposed to fall apart when it hit 100,000 miles)? Sometimes we have to learn these lessons the hard way.

Make no mistake one of the concepts of FI is to have what brings you joy. As Paula Pant says, “You can afford anything but not everything. What’s it going to be?” If your vehicle truly brings you joy over and above reliable transportation from A to B perhaps it is worth a little extra in your budget. But if you are here for the long game, do the math and accelerate your path to FI.

Even if you feel like there is no way you would own a car that is 10 years old, perhaps you just decide to hold cars for 7 years, that savings over time is real! It aggregates and compounds and looking out 10, 20, or 30 years, it could be the difference between an early retirement or having to settle for a traditional retirement. There are many shades of grey on the path to FI, it is not all or nothing, feast or famine, have or have not, there are degrees of decisions than can tilt favorably and increasingly so if you have the mindset to push them a bit further than a pre-conceived comfort zone.

That’s it this week! Take ACTION! Mind the GAP! Start building your net worth with a Turbocharged Engine. No longer do you make emotional decisions when buying a vehicle with respect to timing or price level. Buy what you need and take care of it. It’s just A to B and that could be 7 to 10 more years of retirement. Or go ahead and “keep up with the Jones’s” buy that nice car every 4 years, finance it and you can work till you are 65 or 70 just like them.

Please send feedback or comments, even ideas you would like to see covered in future posts, your constructive input is welcomed and appreciated. Use the boxes below to send your comments.

_____________________________________________

Remember MIND THE GAP! +Income – Expenses = The GAP <– Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER Email: [email protected]

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

or on Facebook: https://www.facebook.com/FIlightER

I send these to my group guys every time a new one comes out and it’s starting to spark some GOOD convos!

GP FOR PRESIDENT!

GOAT Paul!

Randall,

I’m so glad you find value in these postings and share them with your group! The community keeps me motivated! So much benefit can be had by those just willing to have conversations.

Step one is educate! Every day brings opportunities for learning and taking action on your path to Financial Independence! All the best Cleave!

Mr P this is your way to give back! Educating, encouraging those who are ready to make a difference in the lives of their family 💕

Thank you for sharing your years of knowledge and experience.

Miss Gina,

Thanks for the kind comments. Education, awareness, and actions begin to open the perspective and build confidence. These are my motivations for sharing the blog.

An open mind, willingness to learn and confidence to take that first step can truly reward anyone. If one person finds a nugget in my posts, it is a joy for me.

You too are in inspiration!

Thanks again,

Paul

Great examples Paul. We use similar examples in the stewardship classes at our church. It’s amazing how much waste there is trying to drive the coolest, latest hunk of sure-fire depreciation! The better choice is to “mind the gap” indeed.

That ES Turbo looked pretty slick though! 🙂

Thank you for sharing.

So true Robert. Taking the emotion out of these decisions and just backing away and looking at the math and the long term impact and considering opportunity costs. Thanks for your comment and your regular engagement! Good perspective.

Hey Paul,

Great to swap a couple of messages last night on the choosfi blogging seminar. Keep up the good work.

Other Paul

OP!

Great to hear from you and thanks for having a look!

Still much for me to learn! The community helps!

Your site is awesome! Mine screams Rookie, I will have to build my “talent stack” quite a bit!

Lambo