FI-light-ER post 9.0 / FirstPublished20200709 www.filighter.com

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

Disclaimer: We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. FIlighter accepts no responsibility for any actions or activities you may take based on anything discussed on the website, postings, or comments.

9.0 –> Does money flow through your hands with no inhibition? Do you spend it and receive lasting value from experiences?

SPOILER ALERT=> You will gain insight and diagnose your financial WINS or WOES! And pursue what brings you JOY!

This week we talk about heightened awareness with respect to where your money goes. In last week’s post, 8.0 we talked about the book “I Will Teach You To Be Rich” by Ramit Sethi. This week I would like to spend some time talking about one of the key concepts in the book Ramit refers to as “Conscious Spending”. Ramit covers many facets of conscious spending but I want to focus our discussion around two main points:

- Knowing what you spend

- Spending on what brings you value (and not spending on things that don’t)

For you to have any bearing on your personal spending, you have to know what your current habits are and where your money goes. To do this, I’ll take you back to the first of Seven Steps posted in 4.0. If you already did the homework from post 4.0, you are ahead of the game and can skip down to the second section of this post.

Part I – How do I know where my money goes?

As I tell my kids, there are no short-cuts in life; however there are computers that make this step extremely easy. To know where you are currently spending your money, you will need to create a Spending Analysis. To prepare an effective forward look on your personal finances there must be a basis or beginning reference point with a high correlation to future expenses. The goal of this exercise is understand current expenses with a high enough confidence that they can be used as the basis for future projections. Personally to confirm our spending, I began with downloads from bank, credit card, and healthcare account detail transactions for 2019. Using categories included in the credit card and a few added for our needs, all of the data was downloaded to Excel. Utilizing the pivot tables functions in Excel a rough cut was pretty easy. A 12 month look back is beneficial as the annual, semi-annual, and quarterly items will surface as well as regular monthly bills. At a minimum I would suggest going back 3 full months and then add in things that may be paid outside of the monthly frequency like insurance premiums, property taxes, or other “lumpy” expenses. Building a database and using pivot tables provides easy research and spending analysis. This is my comfort zone, yours may be a pencil and paper approach with a stack of bank or credit card statements, use the tools at your disposal.

WARNING: Don’t make this overly complicated. You need to know three things, how much $$, when, and where was it spent? It will become obvious if you need more detailed analysis. Just get something on paper.

To get your action started, use the below categories as a start (most are courtesy of my Chase Credit Card download):

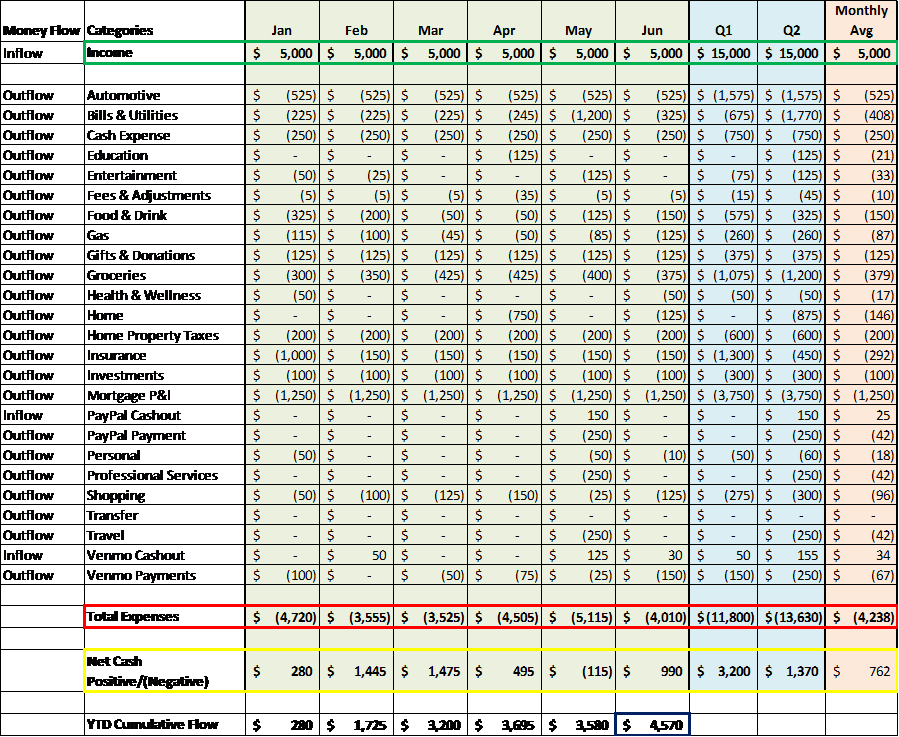

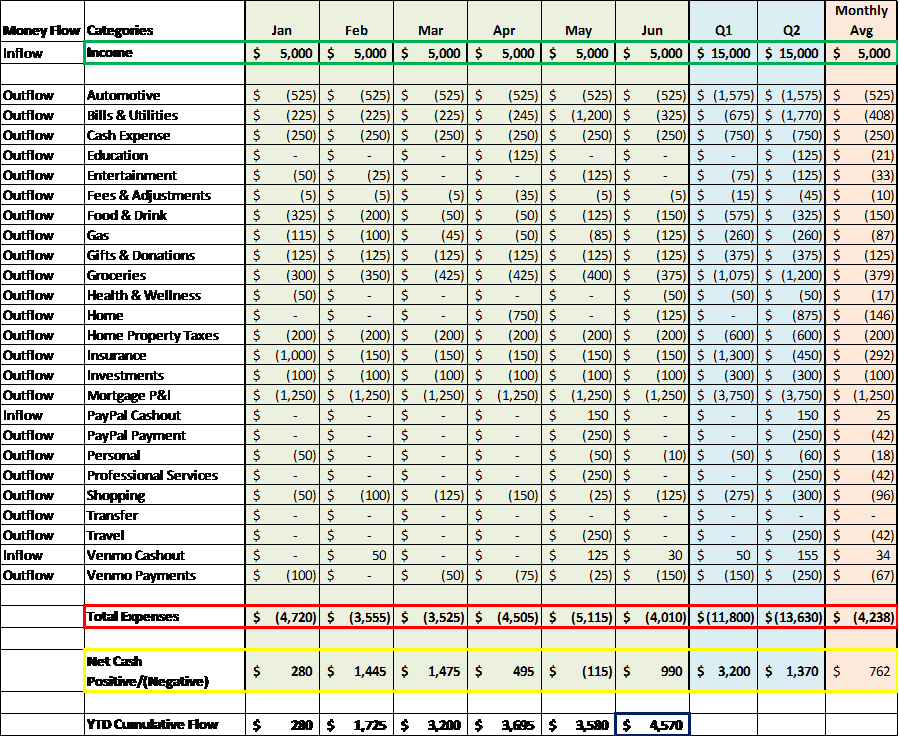

In the sample table above, Franky Filighter is earning $60,000 a year and is paid twice a month for simplicity. All In-Flows are Positive + amounts and all Out-Flows are Negative (-) amounts. We will keep this discussion focused on CASH FLOW not Net Worth. Read post 4.0 if you want to know more about Net Worth. The format above accomplishes several beneficial analytical methods:

- Monthly Trends in the 6 monthly columns

- These are very helpful in identifying what are fixed or routine expenses and what tends to be one off special items. For instance the Insurance category for January included an $850 homeowner’s policy premium that is paid up front for 6 months and the rest of the months include a $150 automotive insurance premium that is paid monthly.

- Note that May Bills and Utilities included a new iPhone purchased after the previous phone was dropped in the river on Memorial Day weekend.

- Did you notice spending on Food & Drink decreased with COVID-19 impact and Groceries increased?

- Quarterly Aggregation

- By aggregating data across three months, the volatility or noise is reduced

- Average Monthly amounts

- When developing budget or forecast spending projections, it is helpful to look at average amounts realizing that sometimes you may spend more or less, for instance in the health and wellness category there was a co-pay for doctor visits in January and June. Most people probably will not visit the doctor every month, but it is a good idea to budget funds in any category where expenses are likely during the next year.

If you are still with me after all the number and table talk, bless you and thank you!! I’m one of the financial guy types and if I see a table of numbers, they just jump off the page and speak to me. If you know where you are spending your money and something is out of line, it will jump off the page at you. On the path to FI or FU money, we talk profusely about growing the GAP. Remember,

+Income – Expenses = The GAP <– Grow IT!

If you are completely unconscious about where your money goes, you will likely spend until you run out, or if you are like many people, you will routinely spend more than you are making. In our example, Franky Filighter only had one negative cash flow month and was able to build an additional month of expenses for his Emergency Fund. Additionally, he invested $100 per month in his long term investment account (no doubt he was using automatic transactions he learned about in post 8.0).

Think about the same example above and Joe Knofeye with a salary of $36,000 a year or $3,000 per month. The expenses shown would not be sustainable. After 6 months cash flow would be negative over $7,000. Is this possible? Of course! A few credit card offers come in the mail and Joe Knowfeye runs up credit card debt to meet his spending wants/needs.

9.0 #protip – if you need credit cards to pay your bills you may not have figured out that there is no money tree in your closet and you do not have a good shot at winning the lottery.

If this is your situation, I will refer you to “The Total Money Makeover”, I mentioned in post 1.0. Get rid of your debt!

Action Needed => Download first half of 2020 to understand your spending by category. Ideally, you will just need to download your Credit Card transactions and your Bank Account Transactions. Organize your data in the same format including month, transaction date, category, $ amount.

Some up front effort may be required if you want to do this every month but the number of transactions will be only 30 days rather than 6 months on future routines. My personal transactions include 848 rows for the first half of 2020. It only takes me a few hours to download format and pivot to analyze two credit cards, two bank accounts, and one health spending account. (While I’m at it, I also update a monthly balance sheet with Asset and Liability balances to calculate Net Worth but that’s another post).

Anyone with basic to intermediate excel skills can become quite proficient at the process and it will get quicker each time. You may want to just do it quarterly, semi-annually, or once a year depending on your needs.

The key is – you have to do it. The fresher the process, the faster, more consistent and thorough you will become.

Now that you know where your money goes…let’s move on to the second half of the post…

Part II – What do you VALUE?

A little story from the Independence Day weekend really hit home. A good friend of my daughter’s and I were having a discussion as we sat over a boat trying to get the butterfly valve on the throttle body to open up with PB Blaster flowing everywhere. The boat under us is 15 years old and the combination of brackish water, salty air, and father time are fighting against us. He looks up at me and says, “This is something people without boats will never understand.” I look at him and ask, “What?” “You don’t buy a boat and worry about how much you can sell it for one day, you buy a boat because you have fun and create memories in it.” I replied, “You are so right! I can’t put into words what you feel as a parent when you are riding in the boat with your arm around your wife driving into the sunset up river with the perfect song on the stereo and your son at the wheel. You remember teaching him to drive the boat safely and then trusting him to take others out skiing. It is just magic. The memory burns into long term storage and there is nothing better.” My wife and I have been around boats all our lives growing up on the coast and we wanted to share the boating experience with the kids and their friends. In this we succeeded and as they say in commercials the memories are priceless.

I talked in earlier posts and on the website www.filighter.com about some life decisions we made on our path to FI (light-ER). The choices we made on cars, houses, vacations, all boiled down to the bigger picture of what we valued. Our faith, family, friends, and community have been high priorities. We support several charitable causes and are active in the community but we have also enjoyed travel, sports, and entertainment experiences.

Getting the balance right and growing the GAP does not mean you eat beans and rice for life or you will run out of money. As they say on the show, “Strange Inheritance” when signing off, “Remember, you can’t take it with you!”

It’s REALLY important to have conversations with your significant other and understand what brings you value or joy. Kind of another way of saying (let’s review from last week):

8.0 #protip –> It is extremely important to know your WHY?

What brings you value? Just as important, what does not bring you value? What are you spending on categories that don’t bring you value?

Do you really enjoy mountain biking?

My buddy goes on a man trip to Utah each year with some other hardcore mountain bikers. He gets serious value from the combination of relationships, scenery, comradery, physical challenge, and time to unplug. He and his wife have grown the GAP and have room between what they make and what they spend thanks to conscious decisions on minimizing the things that do not bring value so they can maximize spending on value rich family experiences.

As Paula Pant says, “You can afford anything, but you can’t afford everything” life is full of priorities and choices and choosing what brings you value and conscious awareness on spending can help you build the buffer we call the GAP that permits you to choose value, grow the GAP, build FI, and live a full life doing what brings you joy!

Resolve to do two things this week:

- Analyze your spending (facts are friendly)

- Write down five things that bring you value

Does your spending reflect your values? Have you grown the GAP to make the Value Activities a reality?

Are you taking action based on this or other posts? Send some feedback or leave a comment!!! Share it with your friends.

I would love YOUR ideas to be covered in future posts; your constructive input is welcomed and appreciated. Use the boxes below to send your comments.

_____________________________________________

Remember MIND THE GAP! +Income – Expenses = The GAP <– Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

or on Facebook:

https://www.facebook.com/FIlightER

Dude! Great advice, I am sending these to my kids all the time

That is GREAT! I hope they find actionable areas to continuously improve their financial health!