FI-light-ER post 3.0 / FirstPublished20200520 www.filighter.com

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

Disclaimer: We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. FIlighter accepts no responsibility for any actions or activities you may take based on anything discussed on the website, postings, or comments.

3.0 –> Previous posts 1.0 and 2.0 really dove deep into the details and perhaps a bit lighter post is in order as we head into the Memorial Day 2020 holiday here in the U.S.A. Memorial Day is set aside to honor and remember members of the United States Armed Forces that died while serving their country.

The financial calendar for this time of year brings back the old adage, “Sell in May and Go Away!” For many years, this actually proved to be a good strategy but since about 2013, investors would have missed some attractive gains over the period from May to September. There is some great perspective and history of this quote going back to an old English saying where many Londoners headed out of town for the hot summer months. Here’s a link to an Investopedia article if you want to read more.

In the case of 2020, we certainly have some optimism as the country (and world) slowly wakes up the economic engine and returns employees to the workforce the economic statistics and more important public company earnings will improve. The Q2-2020 earnings reports may be worse than Q1-2020 with all three months impacted by the national, state, and local Covid-19 orders to remain home and use precautions with hand washing, disinfecting, wearing masks, and maintaining safe distances.

In the last post, 2.0 we discussed thoroughly the importance of perspective and timeframe when viewing the horizon. Think about a view of a clear blue sky horizon and visibility for miles and miles as compared to the continual waves of storms with brief good weather between each downpour and wind gust. The 2.0 discussion was framed around the long term perspective and the fact that the market over time continues to go up. Also we discussed the fact that timing the market is a fool’s folly and time in the market is a more reliable and effective strategy.

This week perhaps a little sympathy is in order to share in the reality that hit each of us as we opened our 2020 monthly and quarter end statements and found our former 2019 ostrich sized nest egg has become a duck egg. There are many scenarios and diverse factors impacting each person’s individual unique portfolio and any points may or may not apply to your situation. We will limit this post to a scenario that uses my actual personal investment results for 2020.

First let’s discuss the emotion and psychology a bit that each of us experience when we see portfolio balances go up or down. There are so many terms to explore, Confirmation Bias, Overconfidence, Hindsight Bias, Recency Bias, Disposition Effect, Mental Accounting, Regret Aversion, Prospect Theory, and Loss Aversion are just a few. There are hundreds of books and articles covering this area but we will just look a bit on recent market fluctuations and the Disposition Effect discussed in the findings of the Shefrin and Statman study in 1985 (this link will retrieve the actual publication). The phrase I want to focus on relates to the following statement “people dislike incurring losses much more than they enjoy making gains, and people are willing to gamble in the domain of losses“. I want to focus on only the first part of the quote as this seems more pertinent to how I (~we) are feeling based on the 2020 market activity. (Yes, I realize the main context of the research is why people sell winners and hang on to losers, but the mindset applies to the feelings around potential losses vs. potential gains and since I’m the editor that’s what we will cover).

I’m certainly willing to admit as I prepared to retire and the bull market pushed portfolio values above my target retirement goal it gave me a good bit of confidence around the decision. My allocation and risk tolerance that allowed the gain also allowed exposure during the entrance of a very angry bear market! (Allocation and Risk Tolerance are future post items). Covid-19, as implications became more understood, impacted the market. How did it make you FEEL? Did the unrealized LOSS hurt more than the unrealized GAINS made you feel good? I can tell you the drop in the numbers coupled with the sequence of return impact was personally very painful. It didn’t help that I had recently read in Todd Tresidder’s book, “How much Money do I need to Retire” that the highest percentage of people that fail in retirement are those that retire when valuations are very high and the situation is further aggravated by a negative returns early in the retirement phase. In his book he provides statistics that using a safe withdrawal rate of 4% approximately 1 out of 5 people will run out of money in retirement when valuations are in the top 25% at the time of retirement (measured as an 18.5 Price Earnings Ratio or higher). I do recommend this book particularly if you enjoy understanding the math side of the retirement perspective. The content above came from a chapter I particularly enjoyed titled “Monte Carlo Calculators And Other Random Myths” found in the first section of the book, “Model 1: Conventional Retirement Planning”. Having personally experienced financial advisors using these type models to provide a score or % likelihood that you have a successful financial plan based on your inputs and returns assumptions; I’m certainly going to take a more cautious view of this type of data as I retired into the opposite of a sweet spot with high valuations across the board in the fall of 2019.

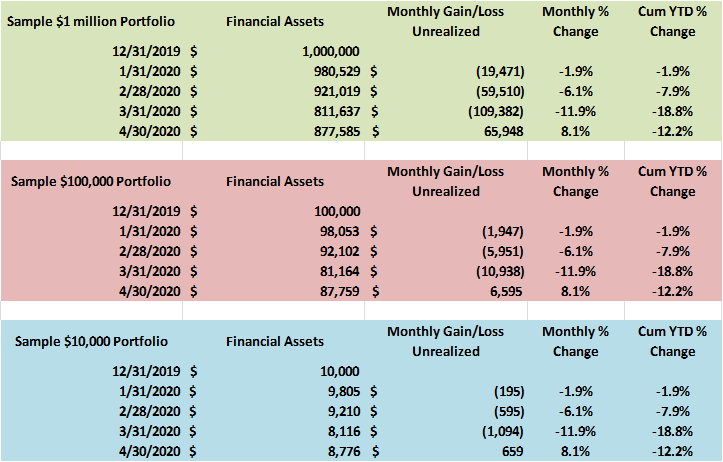

Enough of the sappy background…what is the data? Many readers have a particular love for facts and like to focus on the “So what?” perspective. I can relate to the “Where’s the beef?” mentality… so here are three different data sets. All three sets of data have the exact same increase or decrease each month to the portfolio. The difference is the size of the portfolio. There is a $1,000,000, a $100,000, and a $10,000 portfolio. Think about how you would feel if each of these were your portfolio?

This is the point where I remind you we are not panicking in the midst of this short snapshot covering the first trimester of 2020. The context that we discussed back on post 2.0 is what sets the perspective and creates the feelings and emotions as we digest the numbers. Imagine if you will the $1,000,000 portfolio set of numbers above as a recent retiree and you see that almost ($200,000) has vaporized in the first quarter of 2020. You begin to think about what that money may have been used for like a retirement cabin, an RV and a truck, a nice boat, etc. etc…Who am I kidding, you begin to think you need to return to a W-2 job!!! After you count to ten and realize you have 30+ years in front of you for retirement living, perhaps you are confident the market will recover and proceed to new records completely wiping out the shrinkage of the nest egg. In April alone 8.1% of the 18.8% decline was recovered. Even with this recovery we are down 12.2% year to date. Spending flexibility is one tool or mechanism in your retirement budget that can be rocket fuel if you can ease back on withdrawals during poor market performance years and conversely, enjoy some extra budget spending in good years.

Now we will focus on the $100,000 portfolio. Say you were tickled pink on your success at the end of 2019 as you reached the goal of a six-digit nest egg. This is one of those mental milestones that lends itself to some accomplishment and pride in your diligence to establish savings for retirement, college costs, a real estate purchase, the possibilities are endless. Then BAM! At the end of March you are down to $80K! How did this happen so fast? All that money you dumped in during the last few quarters or years is gone! Not so fast, it has not disappeared; the valuations have just gone down. Each share you purchased at say $50.00 last year is now only worth $43.90 at the end of April. If you are 35 or 40 years old, and have the long view, you are excited as now you are buying new shares at a lower price per share and will enjoy the growth of the price as the economy recovers. The ($20K) of unrealized loss at March may represent a car to you in tangible terms, but in investments you are likely going to leave those shares invested (and continue to buy more at bargain prices) and allow them to return to higher values as the market recovers. Unlike a $20,000 car that typically loses its value every year until it becomes junk yard scrap, your shares of broad based low cost stock index funds will likely recover with the market to new highs. As your retirement approaches, you may continually reduce the risk that these fluctuations have on your portfolio (allocation and risk tolerance, future postings).

If you are just starting out or otherwise have managed to get your investments into the five digit account size perhaps the $1,900 drop in your portfolio set you back on your heels. If you are putting $500 a month into your investments, this drop is not significant in the long term. Your account balance will return to previous levels with 4 months of new contributions. In the future, you may be pleasantly surprised when your share values recover and continue to grow as they have in the past.

Back to our original quote concerning how much more we feel the bad than we celebrate the good. This is human nature in investing and there are approaches to address this perspective. Several months back JL Collins, the author of “The Simple Path to Wealth” recorded a guided meditation for when the stock market is dropping (link here). You may enjoy listening to this file. I personally reflected back to this perspective as the market saw-toothed its way down to the March 23rd lows. This meditation also appeared on a Choose FI podcast as JL Collins is a multi-episode guest.

The point in all this is that human nature doesn’t always make investing easy or even pleasant. But knowledge, experience, and continued education can give you firm foundational perspective on investing. Setting your frame with a longer view can disarm the fear and disappointment that recent fluctuations have caused. We have experienced this black swan event together. There are brighter days ahead.

If you are an American please pause and reflect this Memorial Day weekend on those in the military that paid the ultimate price for the freedoms we enjoy and treasure daily.

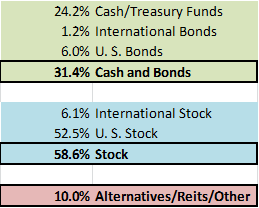

Editor Note: The allocation of the portfolio in the example above:

Please don’t beat me up over the allocation, as I mentioned above everyone has a unique situation and there are reasons for this allocation. What is not obvious above is the allocation by industry segment and the pain the energy industry has imparted to the overall portfolio performance.

Please send feedback or comments, even ideas you would like to see covered in future posts, your constructive input is welcomed and appreciated. Use the boxes below to send your comments.

_____________________________________________

Remember MIND THE GAP! +Income – Expenses = The GAP <– Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

or on Facebook: https://www.facebook.com/FIlightER

Great thoughts. I really enjoyed the discussion on varying perspectives from the market drop. I’ve played around with small amounts in the stock market before putting the majority into a Vanguard S&P index fund a little over 3 years ago and have continued to put away what I can. Initially, as everything kept dropping, I was hesitant to even look at my account. When I finally bit the bullet it surprised me that it was still up decently over my initial investments. It gave me a bit of hope realizing that I’m still way better off than dropping it in a bank. And, some more inspiration to scrape together what I can to buy at discount. Thanks again!

Great Points Thomas,

Stretching your reference point a bit improves digestion of the facts! Adding as you can when you can will likely prove the best strategy!!

I’m glad you enjoy the posts!

Good Luck!