We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

FI-light-ER post 2.0 / FirstPublished20200512 www.filighter.com

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

2.0 –> By now many of you in the FIRE space have been touched by podcasts, quotes, references and more to a combination of JL Collins Stock Series or his book “The Simple Path to Wealth”. Some of you may have seen the excellent documentary movie, “Playing with Fire” where JL Collins appears. I have no official survey but I think it is pretty safe to assume it is the most recommended book to those new to the FIRE concept. As for me this book was a real page turner and I found so many actionable lessons I have bought several copies and given them away.

Why do you think this book along with a few other excellent titles is common amongst the FIRE movement? Could be many reasons, but I’ll just give you some of my personal insight. As a reminder my wife and I are both CPA’s and let me dispel any thought that CPA’s or any Accountant or Financial career individuals are better than the average person when it comes to investing. Investing is something you learn. Perhaps you first learned from your parents, then friends, a college class, your co-worker, a full service financial advisor, a 401k representative, your benefits department, could be any number of opportunities or people that helped to form your knowledge base on investing. That knowledge or perspective may be right on point or a little tainted or one sided. As we continue to explore I encourage you to have an open mind and willingness to learn and expand your knowledge base of personal finance. This book, “The Simple Path to Wealth”, is a great way to start or enhance your knowledge and perspective and is easy to follow.

There was little talk about investing in our home growing up. My first exposure to investing was my second job in the late 80’s when 401k plans were taking hold. Back then 401k’s were pretty simple, you put pre-tax income into the investment choices and would be taxed when you withdrew funds after reaching 59 ½ years old some 40 years later. Our company had a great $/$ match up to 6% of your pay plus a voluntary 2% contribution. Simply stated for every $6.00 you had deducted from your paycheck, the company put in $8.00. These funds were invested in several of the fund options and after 5 years of vesting you could keep 100% of the company match and retirement contribution portion. While I had enough sense to put in the 6% to get the full match, I did not see the complete value of hitting the max contribution and compounding over the next 40 years (another post topic).

What to do with the other money we were making? After hearing about investing from others in the office and having a Treasury and Tax guy around the corner named Gary with a Bloomberg Terminal (a device in the 80’s that let you see what price stocks were trading essentially in real-ish time) a co-worker and I started a little investment club. “The Billionaire Boys Club” which came from a 1987 TV film with the same name. The two of us opened brokerage accounts and started buying individual stocks. Back then you literally had to call a broker on the telephone and place a trade or get a quote. We paid ~$35 discounted commissions on each trade by using a service affiliated with our credit union. I don’t have to tell you how much this process has changed post internet revolution. We generally had positive success in our trades, although we had a habit of selling when something was up 10 or 15% after covering buy/sell commissions. What did we know; we were “Stock Traders” with a capital “T”.

I know this back story is really turning into a death spiral tangent, but hang with me and we will connect the dots to TSPTW. During this period of investing, I had first person experience with the 1987 crash.

[Note in this article, all references to Dow or the market refer to the Dow Jones Industrial Average]

Data from Wikipedia fills the background environment, after the Dow set an All Time High of 2,722 points August 25th, 1987, 44% above the previous year’s close, the decline leading up to Black Monday was the following:

- Wednesday October 14th, Dow Drops 95 points or 3.8% a new one day record

- Thursday, October 15th, Dow Drops 58 points or 2.4%

- Friday, October 16th, Dow Drops 108 points or 4.6% a new one day record

- Monday, October 19th, Dow Dropped 508 points or 22.6%

There is some great background on all the activities that took place over that weekend and the trading policies and models that forced huge sell offs on Monday; here’s the link to a simple summary. My point in diving so hard into this history is the market dropped >30% in less than a week. The Covid-19 pandemic economic impact pushed the current market down from recent record highs a similar amount >30% in a fairly short period as well.

So to relieve your suspense…how did 1987 turn out for investors?

- As compared to prior year end, 1987 was +2.3% above 1986

- As compared to the record 2,722 high for the year, 1987 finished at 1,939 or down (29%)

- The record high was reached again in August 1989 two years to the month from the previous record

- As compared to the 1,739 low for the year, 1987 finished +12%

All these are just data points, (source Macrotrends.net ) but they are interesting…how would you feel if you knew the market would return to record highs in less than two years? Does history repeat itself? Sometimes, sort of…however, these points are more or less important to each of us depending on our base lens view. As I write this post on May 11th, 2020, the market DJIA closed at 24,222 or 3.8% above the beginning of last year, 2019. That’s not so bad really, but (…pregnant pause) we remain down (16.1%) from the beginning of this year 2020. Had I been writing on March 23rd, 2020 we would have been down >(30%). At that low point I was thinking another (10%) drop and I may need to get a W-2 position much sooner than I thought.

What lens do you look through? A few years? A few months? Or remember our discussion earlier, if you are a 20/30/40 something and you have a 20-40 year glide path this doesn’t shake you, perhaps you have enough backbone to remain invested and keep adding to the pile at bargain prices!

One of the most important chapters of the book “The Simple Path to Wealth” is Chapter 7, “The Market Always Goes Up”. It is largely the horizon that you use when setting your own expectations of returns of equities in a market that is volatile. Pull up any 20+ year view of the DJIA in modern history and you will find period after period that trends up and to the right. It’s a fact, given a long horizon; the market will always go up (barring any catastrophic event that will make all the talk about investing less important than human survival). I’m not going to lie, the mental fortitude to remain invested in the market when you have poured in cash and see the quarterly statements down (30%) is overwhelming. You can’t help but start thinking you would be better off if you buried your cash in the back yard or hid it under the mattress. History has rewarded patience over and over during these volatile black swan events.

This brings us to the main topic of Chapter 8, TIMING THE MARKET. I tell my kids and anyone else who will listen; “If you are not in, you can’t win!” this is true in the market. Conversely, if you are out you can lose! Imagine a +25% gain year while you bury your money in the back yard. On top of that what is even worse, inflation eats your cash like termites and you have less purchasing power when you dig it up 10 years later. Hind sight is 20/20 and two facts that come to mind personally are my need for a large “emergency/opportunity” fund and holding too much cash on the sidelines waiting for the market to drop. Both of these issues fly in the face of my own advice. I have improved in some respects but due to my attempt to “wait for the market to drop” much of the bull run was wasted as opportunity cost due to my stupidity that I somehow know better than you when and how far the market will drop, and secondly when it will stop going up. Timing the market requires you to be correct twice, when to buy and when to sell. You have probably heard many times the quote, “TIME IN THE MARKET BEATS TIMING THE MARKET”.

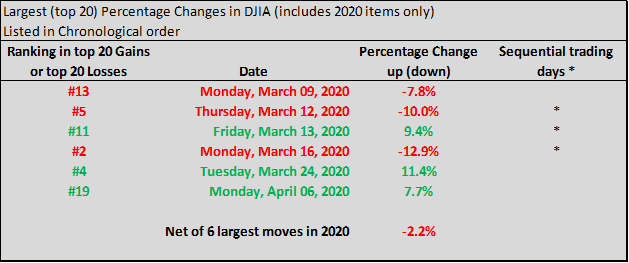

As I did in the 1987 Black Monday discussion, let me offer some 2020 data points from my Wikipedia source. These data points are taken from the top 20 single day percentage gains or losses in the DJIA.

I’m guessing this brings back memories of the craziness on CNBC or FOX Business News over the last few months. It would be so nice if you could pull out before those big drops and double down before the gains. The momentum changes in many cases mid-session on some of the days was completely out of left field. The emotional whip saw that took place from February through April and will continue for months to come can make it difficult to witness. My point is with swings like this, the market is truly unpredictable in direction or magnitude. While you will experience drops if you are in the market (invested), you will ALSO experience GAIN$! Given patience, the market will recover and continue the relentless trek ^ up and -> to the right! Volatility happens but the market will continue to set record highs long after we are gone.

Let me apologize for the craziness of this post, and wrap up by saying, I love JL Collins approach to all things finance and the reality that investing should not be complicated. You can do it yourself successfully, and there are many actionable tips that will help you adjust what you are doing now in a positive way, or just get started. What really moved me was much of the Vanguard discussion and the funds examples in Chapter 10. Before I read 100 pages, I literally opened a Vanguard account in August 2019 and started selling stocks and moving proceeds funds from my E*TRADE and some of my last paychecks to increase my holdings of low cost index funds and ETFs (Exchange Traded Funds). While timing was not on my side for some of these purchases, I am confident I will look back in 5 years and they will all be in the green. I have veered off the “Simple Path” guidelines many times in my own investing history but looking back with 20/20 vision, I wished I would have followed “The Simple Path to Wealth” approach to the letter. That would have put me in the Suze Orman FI category (Ha!).

Editor comments: This post was intended to focus on the book “The Simple Path to Wealth”, however the Covid-19 impact on the economy and my investment portfolio led me to focus on the big picture view of the storm we are in with our investments and how a longer view may settle the nerves. The book does offer quite a bit of insight on these type of market events. The post title alludes to the path I have taken that could have been much simpler and yielded a better result. Those other tangents will have to wait for future posts.

Please send feedback or comments, even ideas you would like to see covered in future posts, your constructive input is welcomed and appreciated.

_____________________________________________

Remember MIND THE GAP! +Income – Expenses = The GAP <–Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

Find us on Facebook at www.facebook.com/FIlightER

Pingback: Post 7.0 –> Two portfolio considerations for today and always! – FIlightER.com

Pingback: Post 3.0 –> We are in it together, …The Market (and Covid-19) – FIlightER.com