FI-light-ER post 7.0 / FirstPublished20200618 www.filighter.com

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

Disclaimer: We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. FIlighter accepts no responsibility for any actions or activities you may take based on anything discussed on the website, postings, or comments.

7.0 –> So much for the gushy great news last week! I’m back in the red and seized last Thursday’s Drop to put in a little more dry powder. Opportunistic Buys …some would call that market timing…but I’d like to say it is more of “Adjusting my Asset Allocation” …. Which brings us to the topics for this week’s post.

1) Asset Allocation

All Equity when you are young, higher bond mix when you get old….well it’s not that simple.

2) Diversification

No, ExxonMobil, Chevron, and Shell does not equal a diversified portfolio.

Let’s dive in a little deeper to these two areas. And for those of you that are picking up a few books and educating yourselves, two books I have read cover these topics very well although they have slightly differing perspectives on the allocation mix suggestions and other nuances, but the guts of the process and theory is consistent. The Simple Path to Wealth by J. L. Collins is one of the books and the current book I got for my upcoming birthday is The Bogleheads’ Guide to Investing (Second Edition) by Mel Lindauer, Taylor Larimore, and Michael LeBoeuf.

Before we wade in too deep a little back story to frame my perspective… you can skip a few paragraphs if you want the main course right away… Back when I was a W-2 guy it never seemed like I had time to read…or at least I didn’t make time to read as much as I wanted. Reading was one of my goals and happily I can say this is something I have achieved but at a cost. With new found learning and education around personal finance came the perspective that many of the things I was doing with our finances was much less than optimal. I found myself getting hit upside the head with a 2X4 repeatedly and as they say on the Choose FI podcast there were actionable takeaways that I needed to … embrace and take action to move in a better direction.

Some of you who know me better than others know I tend to plan, plan, plan, plan, and plan some more, then finally execute flawlessly. This does not always give you ideal results in personal finance. One of my earlier writings (Post 2.0) included the mantra I tell my kids all the time, If you are not IN, you can’t WIN! I have two (there are many more, but let’s start with these two) significant concerns with respect to our portfolio and the topics for this week. The first is an overly conservative Asset Allocation and the second is lack of Diversification. Both of these I have worked hard to address over the last 3 quarters but as they say, it’s a journey.

Early this year, after eating lunch with Jim, a longtime friend…I went back to the house to dig into my accounts and identify how many unique investments we held. Not including a few retirement accounts with employers, I counted over 130 different investments. Many of them were overlapping each other with subtle differences. Some were small, some were big, and the reality was there was no reason for so many. A portfolio of a dozen or so low cost index funds and ETF’s would provide a pretty similar exposure to the market with MUCH LESS RISK.

Let’s start peeling the onion!

ASSET ALLOCATION

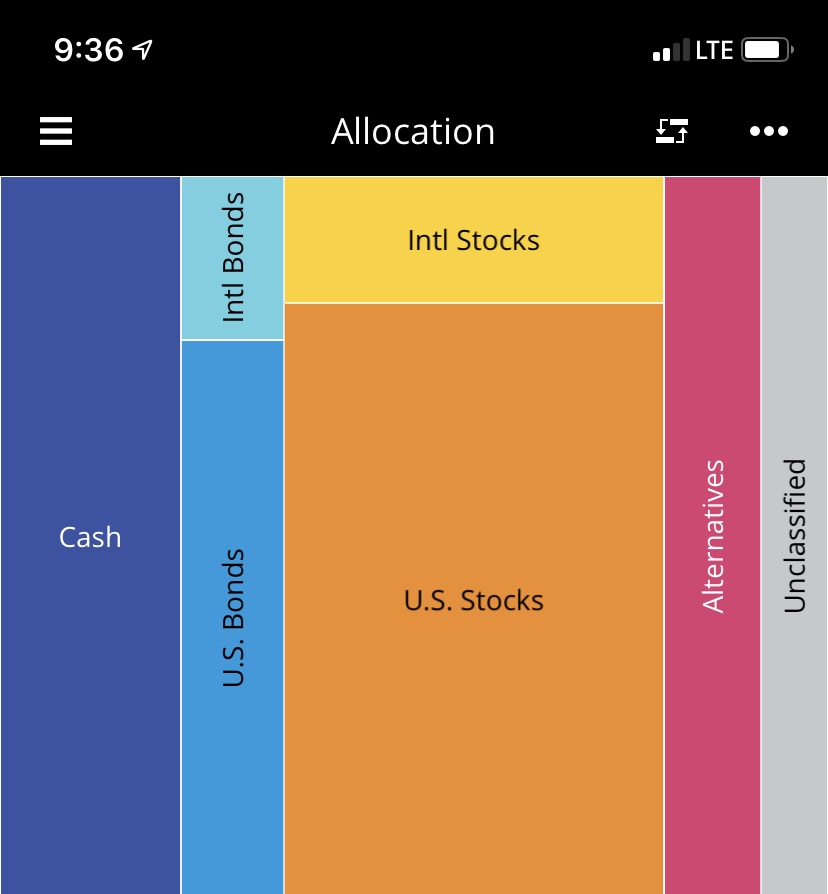

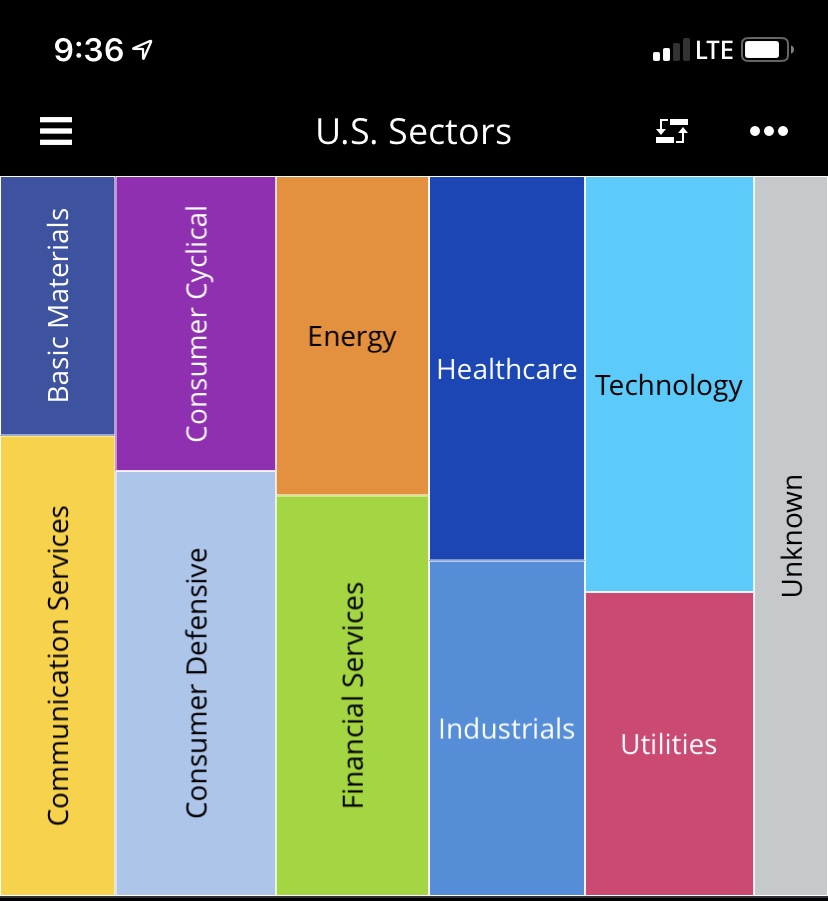

The above photo is from the Personal Capital application that is available free of charge. You may get a call likely from a Personal Capital financial manager offering to assist with you portfolio. I find these tools very useful in aggregating multiple accounts and giving you graphic and numerical representation of your holdings sliced and diced in many ways. Full Disclosure: I am not a paying client of Personal Capital and I am not paid to promote Personal Capital. And now back to Blog Post 7.0…

“The most fundamental decision of investing is the allocation of your assets: How much should you own in stocks? How much should you own in bonds? How much should you own in cash reserve?” – Jack Bogle

This quote opens Chapter Eight on Asset Allocation in the Bogleheads’ Guide and I tend to agree this critical decision will drive many decisions and adjustments along the path to your financial independence with respect to investing.

As you can tell from the graphic above, much of my allocation is held in U.S. Stocks and Cash (Includes money market like funds). It comes close to a 70/30 allocation, or in a more detailed format, 62% Equities (55% U.S. and 7% International), 7% Alternatives (Primarily REITs), and 31% Cash and Bonds. As mentioned in Post 6.0 my goal is to be near a 75/25 allocation thus I will need to increase equity exposure and lower Cash/Bonds from the present allocation. When the market dropped 1,800 points last Thursday, I nudged a little more into the VTSAX and the VFIAX to move the needle closer to 75% equities not as a market timing event, but more like an allocation adjustment ;).

How do you know what your allocation should be?

So many factors can impact this decision from risk tolerance, volatility appetite, time horizon for using the portfolio as to cover expenses or some other goal/major purchase, sleeplessness, etc. etc.etc… The Bogleheads’ Guide distills the process to the following four steps:

- What are your goals?

- What is your time frame?

- What is your risk tolerance?

- What is your personal financial situation?

A key to working through this process involves one of the homework assignments in Post 4.0, developing a Life Plan looking at the longer term horizon and significant goals or needs along that path. The planning exercise should help you crystalize an asset allocation that considers much of your personal situation and goals that may require liquidation points within your portfolio.

Another point that seems fuzzy for many is their risk tolerance. Simply stated if you are afraid of losing money (or value of investments) on any given day, month, quarter or year and it keeps you up at night, you may have a low risk tolerance. On the extreme case, you bury your money in a bank CD or savings account and it rusts away with the impact of inflation and the missed opportunity cost by not being invested in higher return assets you will be disappointed when retirement time comes and the car that your bought 10 years ago for $20,000 is now $35,000 and your savings account has only miniscule gains from 0.05% interest.

On the other extreme being exposed 100% to equities makes great sense for 20 or 30 somethings that have a long time horizon that can take the down years as well as the majority up years to get higher returns over a longer period.

So what to buy?

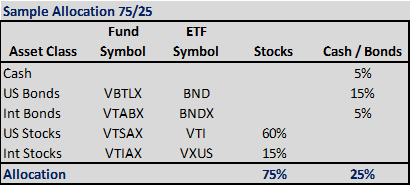

Once you establish your allocation generally between Stocks and Bonds/Cash, the next step is to determine what investments to buy. The number and type of investments are endless, but we are going to take a simple approach and buy four funds using Vanguard as an example for low cost diversified index funds.

Remember this is just an example, we are not financial experts; please seek your own certified and licensed advisors when making personal decisions.

For stock or equity exposure the two funds (Domestic and International) are:

- VTSAX – Vanguard Total Stock Market Index Fund Admiral Shares

- VTIAX – Vanguard Total International Stock Index Fund Admiral Shares

For bond exposure the two funds are:

- VBTLX – Vanguard Total Bond Market Index Fund Admiral Shares

- VTABX – Vanguard Total International Bond Index Fund Admiral Shares

It is important to understand, you can achieve an allocation mix across different asset classes with mutual funds, ETF’s, or even individual stocks and bonds. ETF’s are particularly useful if you have less than the minimum purchase amounts for a fund (some require a $3,000 initial purchase) but still want the diversity in your exposure to different classes. Individual stocks and bonds introduce higher risk if a small number of stocks or bonds are purchased. The low cost index funds above and corresponding ETF’s provide good diversification within each asset class and can be purchased as little as one share at a time.

If four funds are more than you want to manage, consider Vanguard’s Life Strategy Funds that as a bonus hold the asset classes above and these funds auto re-balance periodically to maintain the target allocation mix.

Diversification

Diversification does not have to be complicated. My simple mind thinks about it as the opposite of concentration. Within each asset class, you can chose any point across the diversity spectrum from a single stock or bond to a broad stock or bond index fund holding literally thousands of company stocks or corporate and governmental bonds.

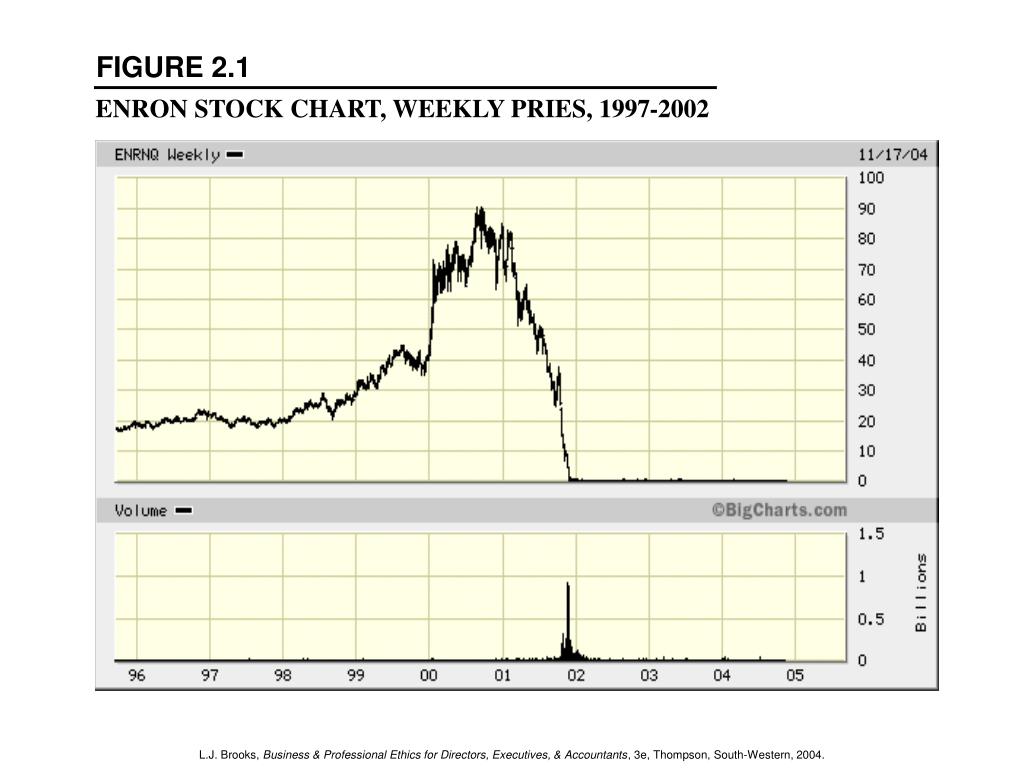

Let’s just think a little about concentration. Remember Enron? Here’s the stock chart (source: slideserv.com)

If your only equity holding was Enron purchased in 1998 for $20 per share, about two years later it would hit $90 per share, a 450% gain over a two year period! Not a bad choice you think, until…at the end of 2001 Enron is worth pennies per share almost a (100%) loss. This is about as good a reason as there is to be diversified and not put all your eggs in one basket within one asset class.

While it seems like this is just a shock factor ancient example, think again.

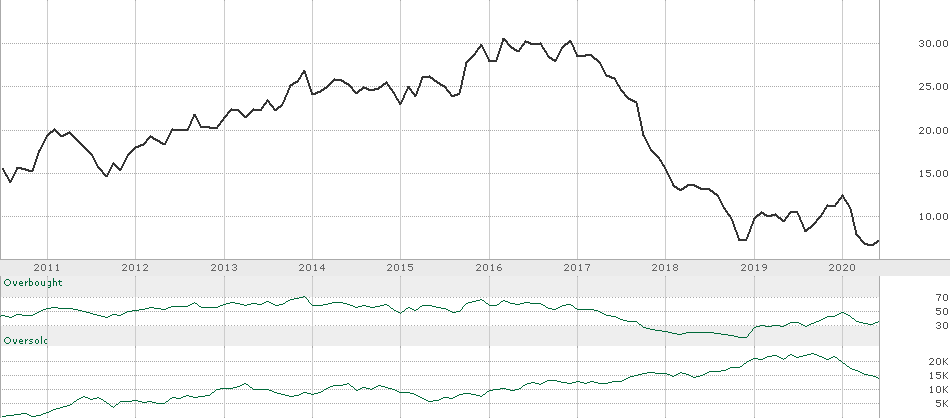

Look at MCI, GE, or even the broad energy sector decline. Companies like ExxonMobil long considered the best in class holding within Energy. Along with the Covid-19 crisis the reduced demand for oil and the oversupply caused XOM to fall to the 30’s.

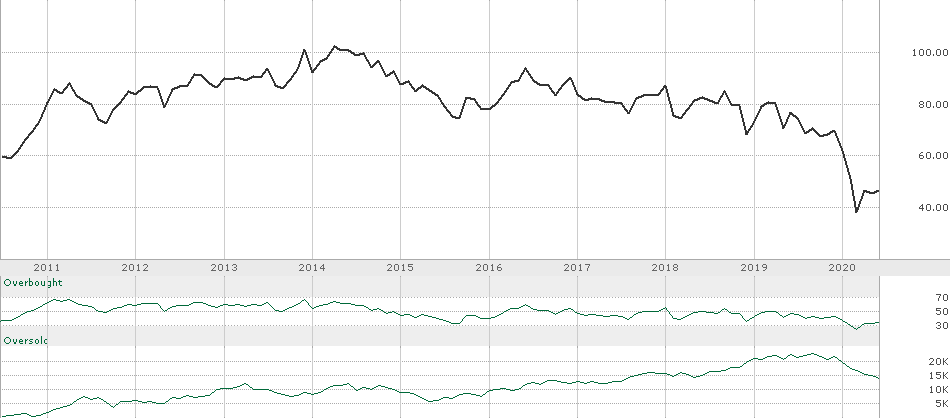

And here’s GE’s stock chart, of course I bought heavy in the $30’s in the late 2000’s because hey, GE is a great company and I listened to Jack Welch all the time on CNBC interviews. Just to be clear I did not sell in 2016 because it was recovering to be the great company it once was…NOT. I continue to take tax losses on GE to offset gains. It is painful every time.

A good reason to be diversified not only in holding multiple companies stock to mitigate the impact to your portfolio if one stock falters, but also to have exposure to multiple sectors if you will within the markets. In any given year, Technology may be a leader and Financials may be declining, having exposure to the winners is difficult to predict but broad funds will include the whole market. An example of various sector exposures from my personal capital account follows.

Having diversification among asset classes and within each asset class can go a long way to help you sleep at night and remove the fear of headlines on the morning news causing one of your individual holdings to go to zero.

If you must trade and own individual stocks, include it in your allocation say 5% of your equities as your speculation funds. I’ll admit I have a bit of a bug to buy stocks and now I’m slowly selling the individual holdings and moving to index funds. The hard part is selling stocks that have dropped 95% and taking the loss in an IRA account that has no tax benefit to apply the loss as offset to capital gains.

Key Take Aways

1) Set your individual allocation to balance return goals appropriately between Stocks and Bonds/Cash. Realize that there is usually an inverse correlation to Stocks and Bonds that soften the down cycles and these also sometimes constrain the up cycles but provide lower risk. Consider your timeline for needing funds from your portfolio.

2) Diversify your holdings across an asset class to mitigate the negative impact to your portfolio. Realize that many studies have shown that most managed funds cannot beat the index over a longer period.

Focus on your allocation goals. Does your portfolio reflect the mix you selected? Is it time for you to take action and make some changes?

Has the lack of diversification impacted your net worth? Did you own too much of your company stock only to have it fall with the sector?

Future posts will deal with Rebalancing, a process that will help you maintain the target allocation you have established.

Please send feedback or comments, even ideas you would like to see covered in future posts, your constructive input is welcomed and appreciated. Use the boxes below to send your comments.

_____________________________________________

Remember MIND THE GAP! +Income – Expenses = The GAP <– Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

or on Facebook: https://www.facebook.com/FIlightER