FI-light-ER post 6.0 / FirstPublished20200611 www.filighter.com

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

Disclaimer: We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. FIlighter accepts no responsibility for any actions or activities you may take based on anything discussed on the website, postings, or comments.

6.0 –> Spoiler Alert…I’m no economist nor do I know what and when The Fed or President will do something that will move markets…….but…WOW….just wow.

Back in posts 1.0, 2.0, and 3.0 we covered the market fluctuations and some concepts from “The Simple Path to Wealth” by J. L. Collins (TSPTW). At the time of those writings, I was preparing for a much longer and slower recovery of the markets. It now appears that the rapid government response to stimulate the economy through a$$i$tance and lower interest rates have revived confidence in a recovery.

But how quickly can that recovery be reflected in your individual investment accounts?

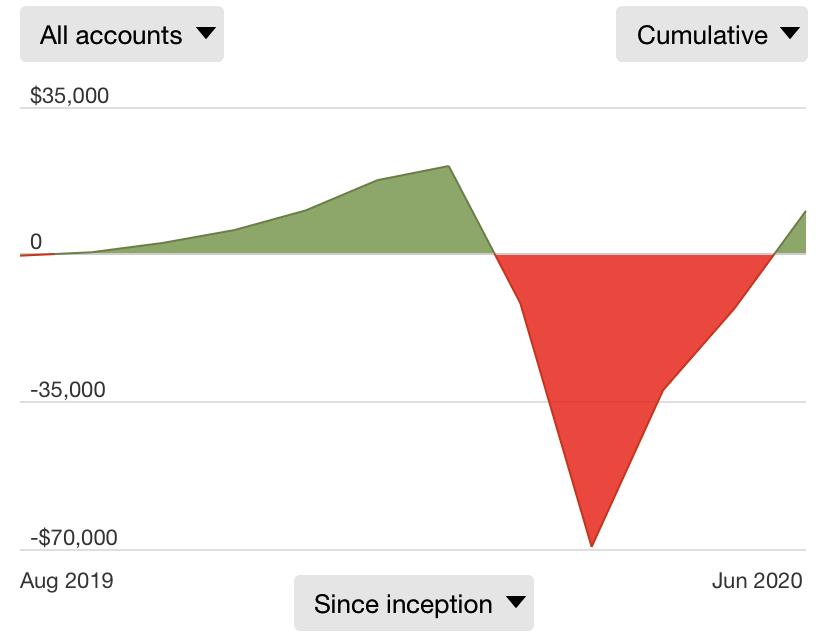

(This chart above covers August 2019-June 9, 2020 for my Vanguard account)

As it turns out, recovery can happen quickly depending on your individual portfolio holdings.

While the balance in this Vanguard account has not achieved the high water mark which included gains in market value plus reinvested dividend income, it has returned to positive territory. Going into the downturn I had approximately 80/20 mix Stocks/Bonds & Cash in this account.

The purpose of this post is to make much of the concepts the FI-light-ER blog has covered in the past real. You know by now I like facts and data and sometimes get a little thick on the analysis. This week’s post simply covers the one issue you have heard over and over, sit tight and stick to your personal investment strategy.

If you listened to the J. L. Collins meditation from post 3.0 giving you actions and perspective when the market is dropping perhaps you have recovered much of your losses during the past few quarters. As I read TSPTW it inspired me to open a Vanguard account and primarily invest in low cost index funds and ETFs.

How did this experiment work out?

Having read that statistically it is better to invest funds as soon as they come your way (if you are truly investing for a longer term) rather than layering them in over time, 80% of this account was invested between opening in August 2019 and January 2020 (much at record highs). This was definitely not a case of wait for the drop and then invest to capture and amplify the upside gains. Another full 10% was added in February before the dismal March drop. The final 9% was invested across March-June.

Did you sit tight through the downturn we covered so thoroughly in post 3.0? Or did you capitulate and sell on the way down and lock in losses? Why were you patient? Why did you sell? Do you have an investment policy? Did you follow it?

Many of us have experienced these black swan events in the past and know what the result will be if we just sit tight and remain invested. The question usually is how long is the recovery going to take? In this case it appears the market was irrational on the doom and gloom side in March and presented an upside opportunity if you had confidence and new money to put to work.

What did I learn (again):

- Calm patience is rewarded

- It is painful if you let the unrealized losses get to you

- Note the graphic above, I started investing in this account in August 2019 after taking early retirement and in March of 2020 the account was down almost ($70,000)

- On January 31st, 2020 I was pretty happy to be up over $20,000 and 60 days later I was down ($70,000) that is a ($90,000) move the wrong way

- Continued investment amidst the chaos is rewarded

- During the third week of March I nibbled and picked up a few shares of the VTI in the low 120’s and high teens and on March 23rd I picked up 2 shares at $110.16, today it closed at $161.39, up 47% from that low (Why only 2 at this price? Because you don’t know it’s the bottom until the market climbs out)

- Specialized funds or sector specific funds may have a longer (or shorter) recovery period than the broad VTSAX/VTI type funds, I would have preferred more broad funds

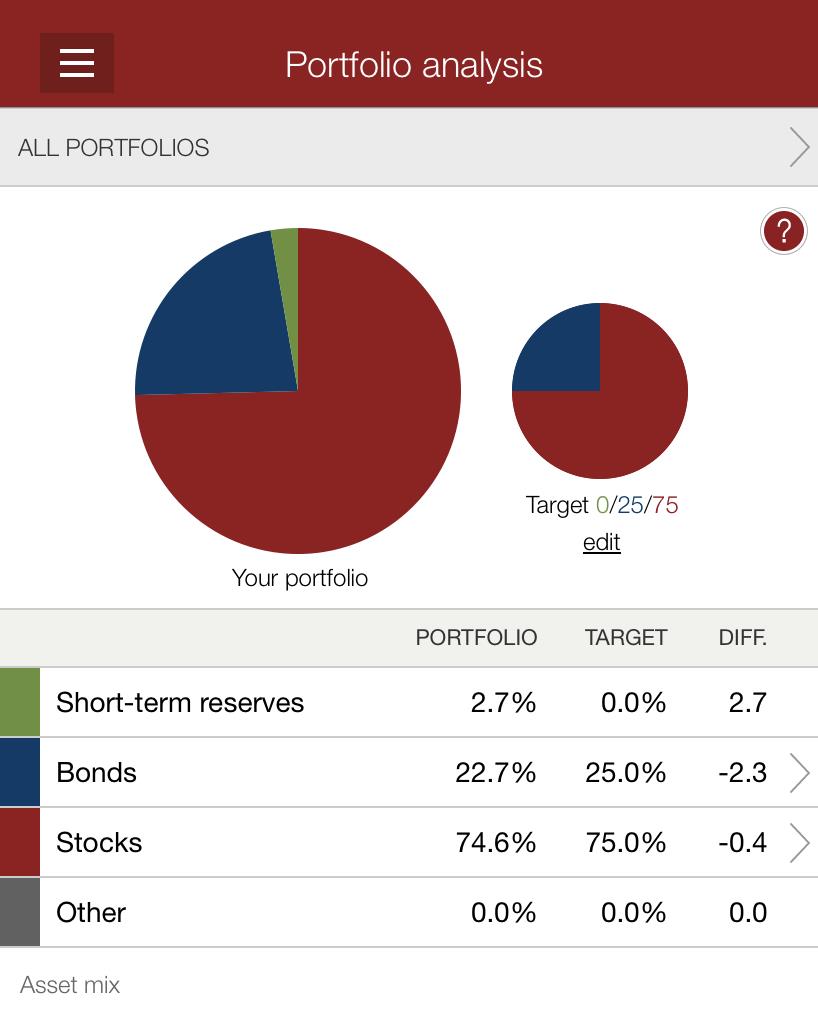

- My sector weightings will need some re-balancing

- My risk tolerance was not as high as I thought it was, having experienced this level of pain and learning I have drifted down to a 75/25 mix and will likely hold there

- I do agree with much of the writings concerning early retirees with a long horizon, those writings suggest you must remain exposed to equities to fight off the impact of inflation and allow the portfolio to maintain a high enough return to support withdrawals

It was tempting to put other buckets of reserves in the market at the low March levels but back to having an investment policy and financial plan, those funds are not exposed to the stock market for a reason. That reason is to prevent the need to sell at depressed levels to cover expenses. This approach is designed to allow the normal cycle to return portfolio values to higher ground. Remember you can’t time the market but you can continually invest over time regardless of market volatility as funds are available.

Takeaways:

- You have lived through a black swan event (or at least the first part of one) and can appreciate the first hand emotions that you experienced and how you may be able to keep them in check next time the market drops.

- Continued or automatic investing through the cycle helps enhance your portfolio values when recovery takes place.

- Panic selling (another word for market timing) on the way to the bottom is seldom matched with buying in at the bottom and experiencing the full benefit of the recovery. The market timing game requires that you are right twice, when you sell and when you buy. Resist this temptation.

- Having a long term horizon, as you should if you are an investor, guides your policy and actions and can ease the anxiety or nerves that accompany negative volatility.

As for my biggest personal take away, the TSPTW approach was something I believed but putting it in practice/experimenting with a portion of our assets made it real. This is a viable approach for our investing across retirement and other accounts and I plan to continue to deploy the tenets of the strategies.

How did you do in the COVID-19 Investment Cycle? Let us know in the comments below. Did you learn anything else through this experience?

Please send feedback or comments, even ideas you would like to see covered in future posts, your constructive input is welcomed and appreciated. Use the boxes below to send your comments.

_____________________________________________

Remember MIND THE GAP! +Income – Expenses = The GAP <– Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

or on Facebook: https://www.facebook.com/FIlightER