| We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. |

FI-light-ER post 10.0 / FirstPublished20200723 www.filighter.com

Looking for the FILIGHTER Podcast? FILIGHTER PODCAST LINK

FI-light-ER – n.(Financially Independent achieving slightly Early Retirement)

Disclaimer: We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling. FIlighter accepts no responsibility for any actions or activities you may take based on anything discussed on the website, postings, or comments.

These lies have absolutely more impact on your pursuit of Financial Independence than you can imagine.

What are the lies?

- I’ll buy it now and return it if it doesn’t fit or meet my needs.

- I’ll pay off my credit card in full each month.

- I will start saving for retirement later and make it up.

SPOILER ALERT: English is not my best subject but I have created my own suggested thesaurus additions:

Later == > Never (those that know me know the quote, Later is Never)

Tomorrow == > Never / Too Late (almost the same as Never, but usually equals “much later”, when do you really take action?)

Let’s start with the first lie.

1) I’ll buy it now and return it tomorrow or later if it doesn’t fit or meet my needs.

Go look in your closet RIGHT NOW! Are there any items in your closet that still have tags? I rest my case!.. OK it is about more than clothes, but that is usually a good place to start. Extra belts, shoes that were not the right color, trendy styles that are not “in” any more, and accessories that never made the cut to wear “out”.

Sometimes it is a much bigger deal than a pair of shoes; it can be extra cars, extra motorcycles, extra boats, extra homes, extra extras…!!! These items that seemed like a good idea and for whatever reason are not utilized or enjoyed as much as you imagined.

Did you envision TV Commercial like RV Travel and after the first trip decide that emptying the holding tanks was more UNFUN than the time in the trailer was FUN? Were the kids too old to cherish/value the experience, did you miss the window of opportunity? Maybe sometimes renting before buying is REALLY a good idea!

Don’t get me wrong, many people are diligent in returning items and don’t let the sun set on receiving something in the mail or at home (in the non-fitting room COVID-19 times) and making the decision to keep or return and follow through with the transaction/shipment.

How many times have you let too many days go by and cruised past the return deadline? Most of the time? Never? Always? (I hate to even type Always and Never as they are not allowed to be used in our home, why? Because you are usually wrong, there is almost always an exception you never think about).

2) I’ll pay off my credit card in full each month.

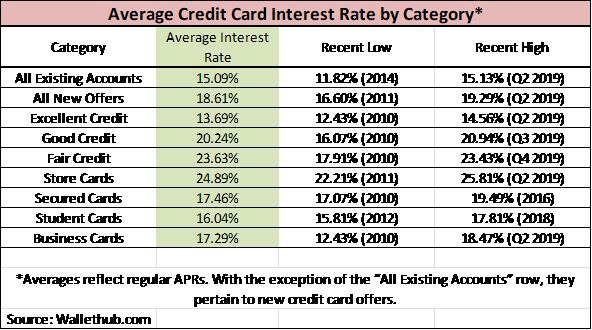

Many of us rationalize that we can get extra benefits from charging and using specific cards. [If you pay your cards off every month in full, even better using auto pay, this post is not directed to you]. Some have even gone so far as to use credit cards in place of an emergency fund. How consistent are you on paying off your credit cards in full? Do you know the interest rate on your balances that are rolled over? According to wallethub.com the average credit card interest rate is 18.61% for new offers and 15.09% for existing accounts. See the table below from their website:

How many of you would like to make these returns on a portion of your portfolio even in light of the default risk? The absolute most guaranteed ROI on your money is to pay these cards OFF rather than rolling any balances over. Even worse is the thought of paying 20% interest on a tank of gas or meal out that is long gone! Short of payday loans, this is about the worse debt to carry.

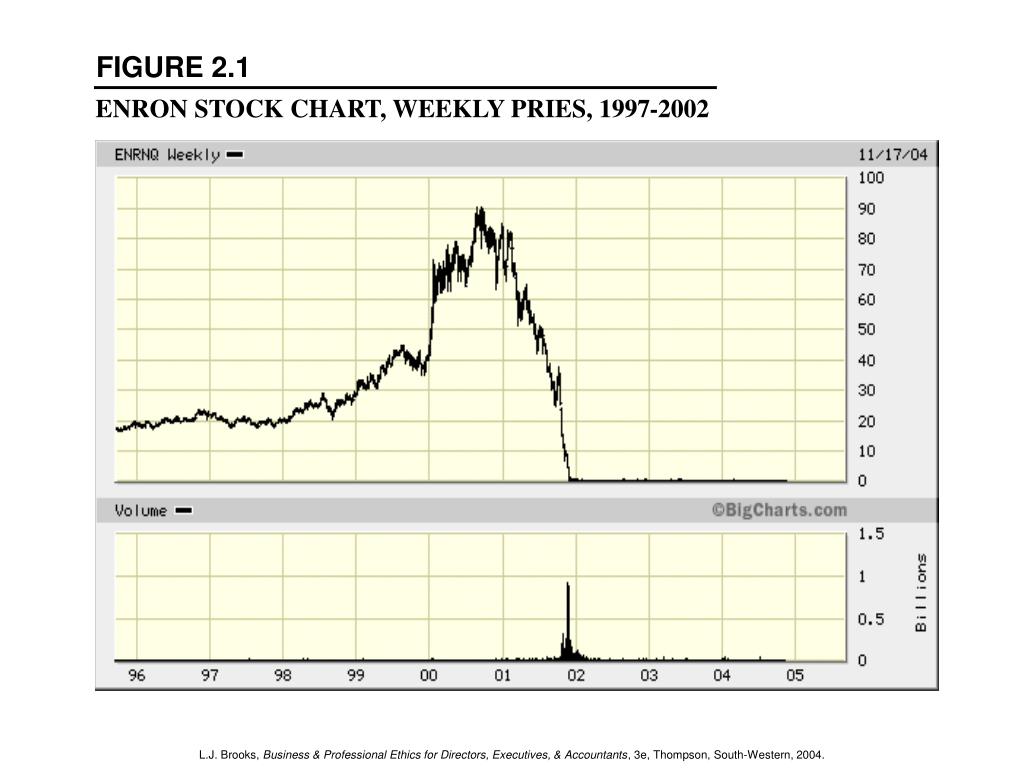

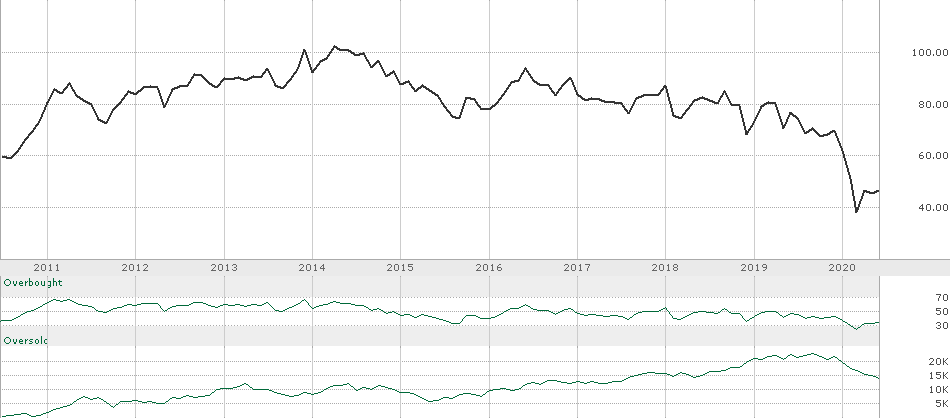

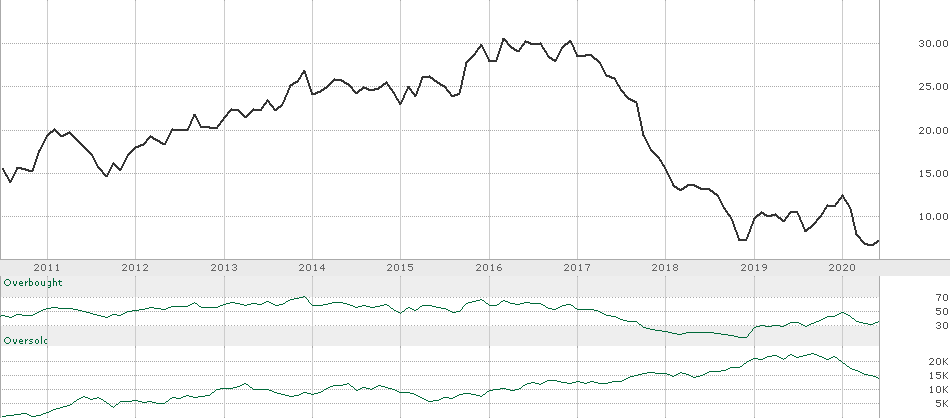

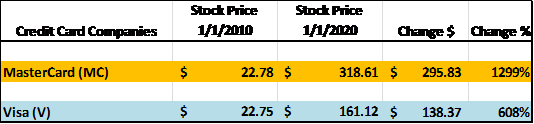

Do you really think the credit card issuers are losing money on the cash back offers, loyalty points or promotional balance transfer rates? Here are a few 10 year stock quotes for MasterCard and Visa:

Would you like to make 13X or 6X your money in 10 years? Who wouldn’t? Let’s move on.

3) I will start saving for retirement later and make it up.

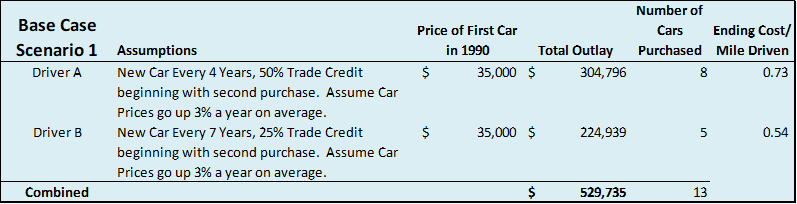

This is arguably the most important item on the list. It can make the path to financial independence steeper and harder than you can imagine. A spreadsheet of course is the chosen mechanism to communicate this example.

WARNING: If you are one of my more mature readers, don’t beat yourself up over this one, time is an unrenewable resource. Do your best to save going forward, it is never too late. You can however help the young people in your life understand the value of starting as early as possible.

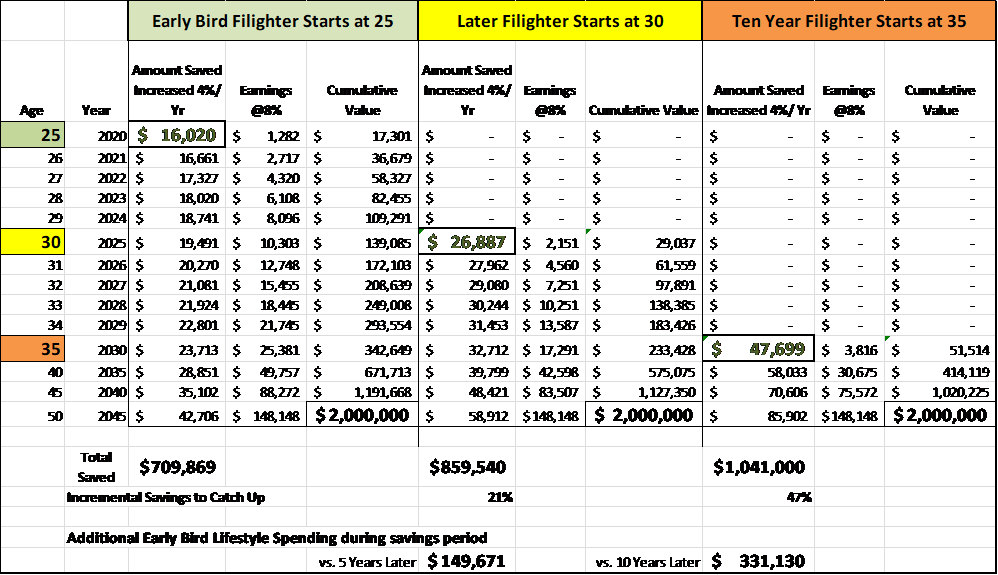

For simplicity sake, all three in our example have the same $2,000,000 FI Goal by age 50 and we assume each family will be capable of making lifestyle changes to make the savings/investing deposits required to catch up. After reaching 50 they will all live on about $80,000 per year using the 4% rule.

Early Bird Filighter starts saving $16,020 per year at age 25 to make his goal by age 50. Later Filighter starts 5 years later, age 30, but must start by saving $26,887 per year more than 1 ½ more than Early Bird. PAUSE…did you get that, by waiting 5 years, he had to save more than $10,000 more per year than if starting at 25. Finally, Ten Year Filighter waits till 35 to begin but must save almost triple the amount Early Bird did starting at $47,699 per year.

The loss in time value compounding translates to $331,130 more than Early Bird that Ten Year must put in to catch up. Stated another way, Early Bird Filighter can enjoy $331,130 more in lifestyle spending during the 25 year period and still make his FI Goal. [For more on this you may want to read about YOLO vs. SLOFI in The Fioneers post]

As promised, here are the numbers:

So what?

How do you avoid these missteps on YOUR path to FI slightly ER?

- Don’t even buy it. Then you won’t have to look at it (the proverbial IT) hanging in the closet with tags and never worn finally to be donated.

- If you can’t afford to pay off your card don’t even make the purchase. But if you do have a balance you can get guaranteed ROI on paying it off. Guaranteed at say 15-20% APR. This is why it is generally better to pay off credit card debt than beginning investing.

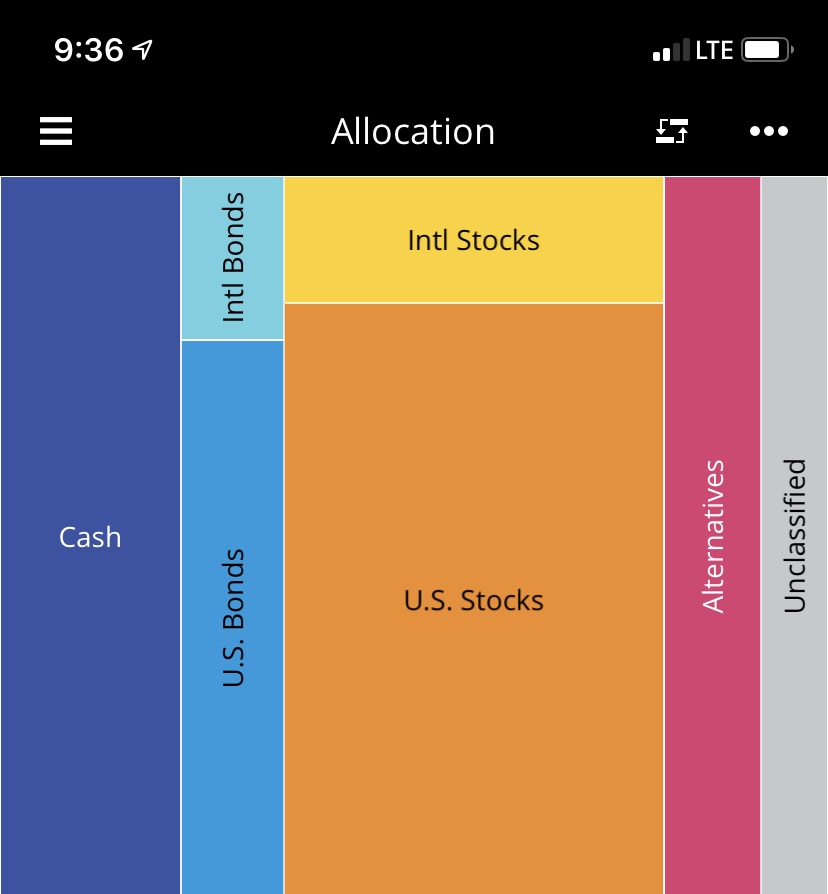

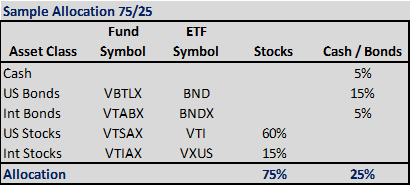

- Start Investing NOW!!! Not next month, next quarter, next year, stop it with the excuses.

- Get started in any matching benefit plans with your employer first

- Consider a Roth or Traditional IRA Contribution

- Build your after tax investment account

Resolve to do these things this week:

- Sleep on any purchases >$100 at least a night before proceeding, many may die

- If you are carrying balances on a credit card, make a plan to pay it off as quick as possible, adjust your spending near term until the crazy balance is gone!

- Automate transfers monthly or every paycheck to your investment account

- if you don’t have an account, see Post 8.0 –> Just Do IT! Take Action to Build your Investment Confidence…Its AUTOMATIC!

Are you taking action based on this or other posts? Send some feedback or leave a comment!!! Share it with your friends.

I would love YOUR ideas to be covered in future posts; your constructive input is welcomed and appreciated. Use the boxes below to send your comments. Join the Facebook page it’s a great place for comments and community sharing.

_____________________________________________

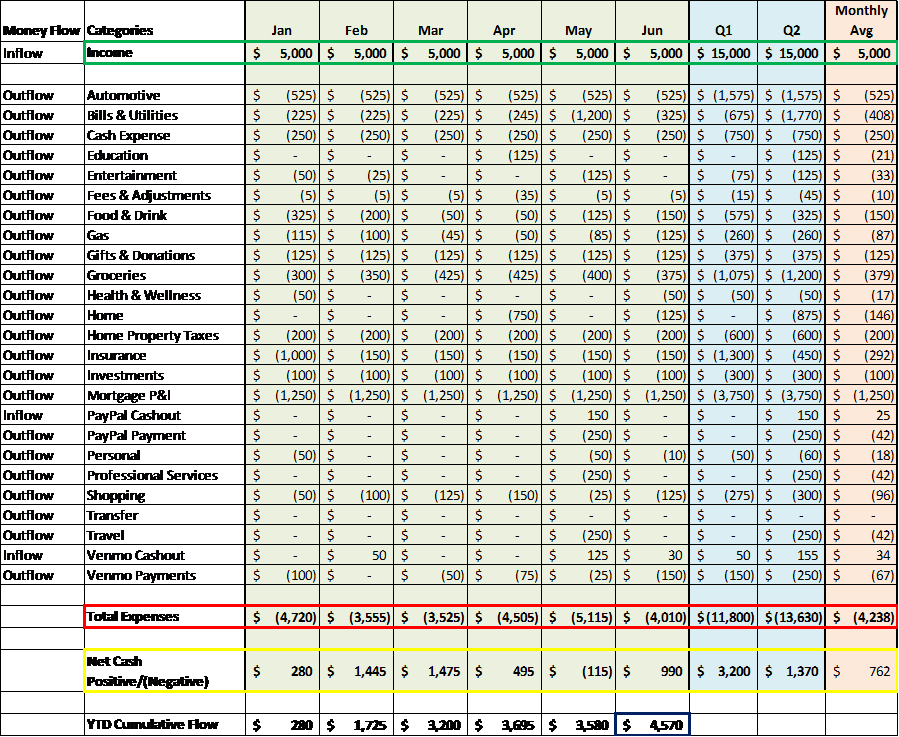

Remember MIND THE GAP! +Income – Expenses = The GAP <– Grow IT!

Stay tuned for Weekly Posts by Thursday each week.

Lambo the FI-light-ER

We are not Tax or Investment experts and are not in any way providing expert advice. Please seek your own tax, legal, or other professional for advice and counseling.

or on Facebook: https://www.facebook.com/FIlightER